61% of people are more worried about running out of money in retirement than dying early. It makes sense as people are living longer, health care is getting better and inflation and cost of living is rising.

Everybody wants to live without any worries related to finances. The only way to do this is to start saving early and invest those savings wisely. Saving a tiny fraction of your income over a period of several years can add up to a significant amount of money. When you factor in compound interest, you can be sure of creating a healthy nest egg for you and your family. There are many types of investments you can put your money in, they range from fixed savings accounts, to bonds, to the stock market and annuities. If you want growth for your money without risk of losing any of it, you should consider an indexed annuity.

Insurance companies protect cars, houses and lives, it makes sense that they also protect money. These products come in the form of annuities. Annuities are simply aggressive savings accounts held by the insurance company. They can be started with a single lump sum or made with regular contributions over time similar to a 401(k). In return, you will get a lump sum of the principal and interest or you can opt for regular income payments made over your lifetime.

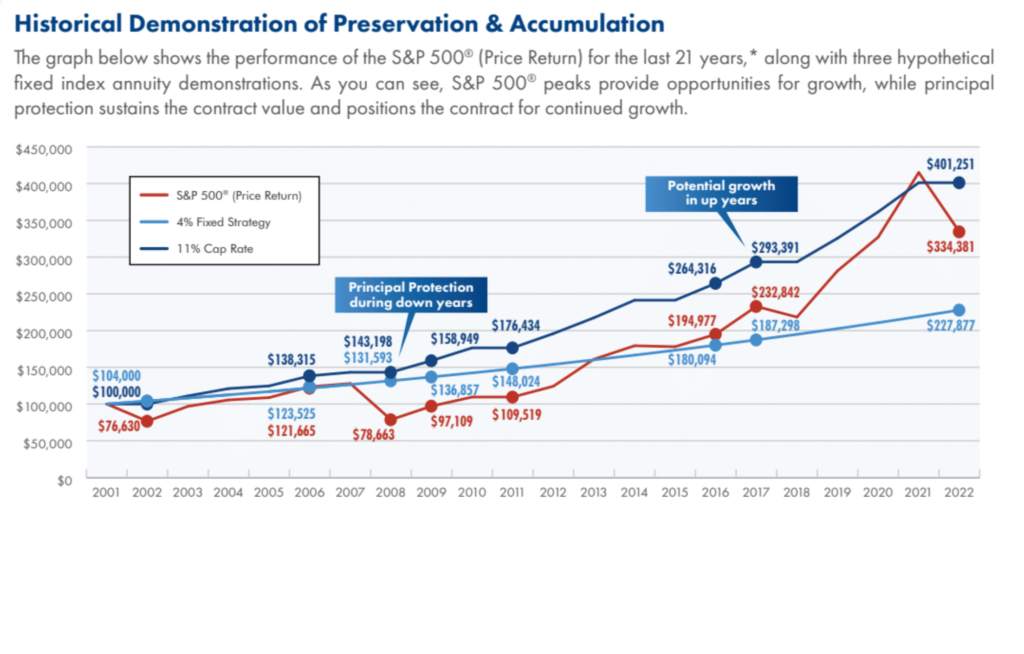

These accounts are contractually guaranteed to never lose any money, regardless of any downturns in the market. You are able to participate in the upside of the market without ever losing any money or sleep.

We all remember the market conditions in 2001 and 2008, the largest influx of retirees returned to the job market because they lost 40% of their retirement savings in what seemed like a dramatic overnight occurrence. And of course, the market went back up, but the question is, do you have the time to wait for the market to come back?

These are insurance contracts that pay a fixed rate of interest on the money invested. The interest does not fluctuate whether market rates go up or down. It is very similar to a CD offered by a bank with a little bit more flexibility.

At Legacy Partners Financial Network, we offer different types of annuities meant for different types of investors. We understand that there are people who want to invest for the long term as well as others who want to invest for the short term.

These are insurance contracts that pay a fixed rate of interest. The interest does not fluctuate whether the market rates go up or down.

Variable annuities are exactly that, they vary with the market. They will go up and down depending on the market and the allocations you choose, similar to a mutual fund.

This is a combination of both fixed and variable annuities. This means that the investor can enjoy the guarantees offered by fixed annuities as well as participate in market growth without any market loss.

If you have ever felt overwhelmed by all the different financial products and names out in the word today, you are not alone. It can be daunting and often because it feels overwhelming, most people do not take the first step to start. We hope to provide you with a general guideline here to help lay a basic foundation. The hope is that you will feel comfortable to continue your journey in financial literacy and wealth accumulation. We are standing by to help provide clarification and guidance and partner with you in this journey.

Essentially there are tax deferred accounts and tax free accounts. All of these accounts are typically tax deferred: 401(k), 403(b), 457, TSP, traditional IRAs, SEP-IRAs. You may be wondering if they are all essentially the same, why there are so many classifications, it is because of the origination point. 401(k)s are private companies, TSPs are government employees, etc. Once you leave a job or retire, they can be left there or they will all roll into an IRA (Individual Retirement Account) because it is no longer tied to the employer. There are tax free accounts like a Roth IRA and there can be Roth 401(k)s and Roth TSPs as well.

All of these accounts can go up and down with the market because they are typically invested in mutual funds, whether that is in the US and it is tied to the S&P 500 or the Dow Jones or if it is invested in international markets. Regardless, they are going to swing with the market fluctuations.

When growing your money and your assets, it is good to understand your risk tolerance. A lot of financial advisors will try to allocate your funds so you can earn money and try to minimize the risk of loss. Unfortunately none of us can actually predict the market. Hedge funds spend millions of dollars investing into algorithms to try and predict the market fluctuations by the half second and still they can and have lost money. The benefit of a fixed indexed annuity is that you can link your growth to the different indexes and be contractually guaranteed too never lose money.

Legacy Partners Financial Network believes in putting the client first. We understand that you worked hard to save and put aside for your retirement. These should be what we have fondly grown to know them as, the golden years. These should not be times, staying up late at night, wondering if this next market crash is going to put a sudden end to our retirement and we find ourselves looking for a part time job to make ends meet. This is a time for security and stability in our income and we are determined through our extra value added services to help your family as if it was our family.

We have a network of agents spread across the entire United States to service families and deliver quality service during the times we have worked hard for and and worked hard to enjoy.

Need help choosing products and services to pursue your financial goals? Our financial professionals are standing by with the insight and tools you need to put them within reach.